Bank of Canada interest rate

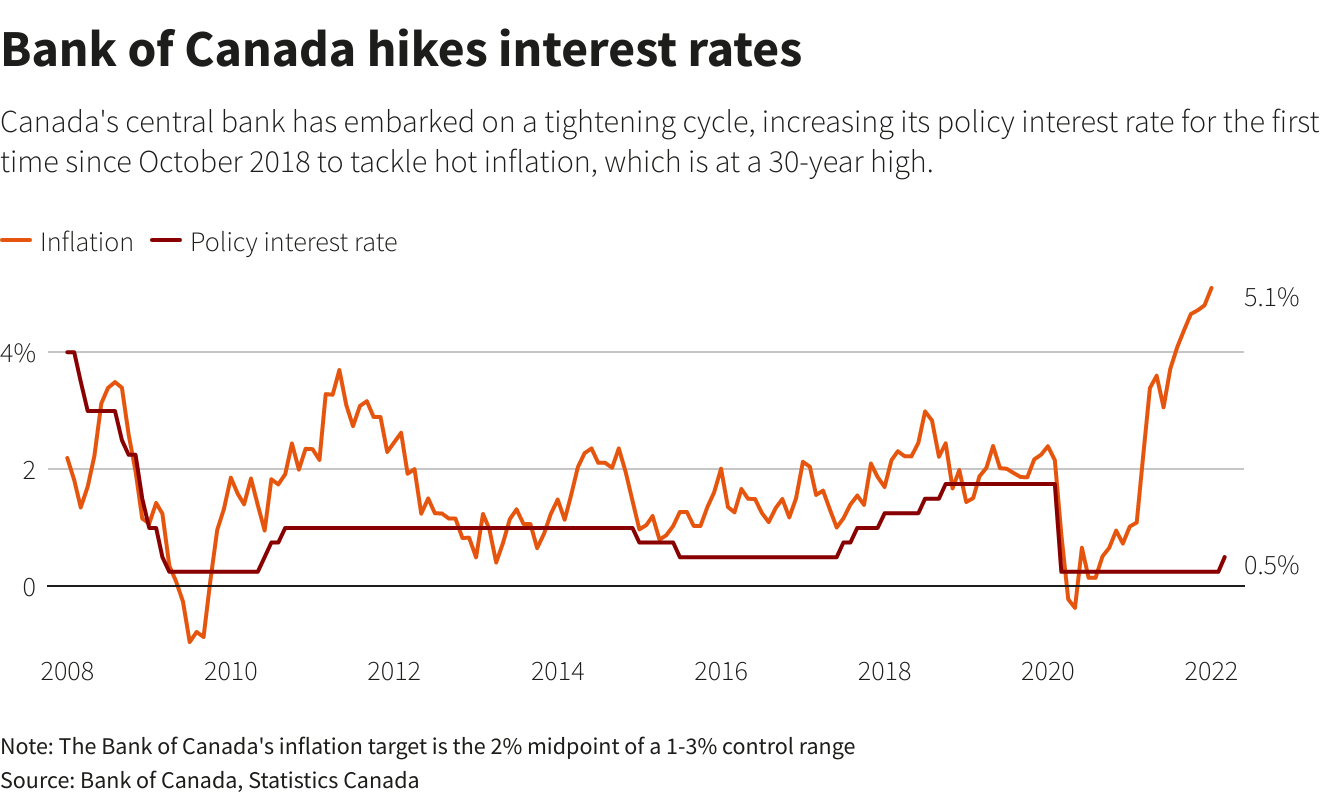

Odds are growing that the Bank of Canada will issue an interest rate hike earlier in the year than forecast as inflation soars to 30-year highs. Bank of Canada needs to retain credibility by raising interest rates.

Holding Interest Rates Steady Bank Of Canada Keeps The Door Open For A Cut The Real Economy Blog

Despite the central banks latest guidance that it wont hike rates until the middle quarters of this year economists at JP.

/https://www.thestar.com/content/dam/thestar/business/opinion/2022/04/09/bank-of-canadas-main-interest-rate-goal-is-to-avoid-financial-crisis-not-just-fighting-inflation/tiff_macklem_bank_of_canada.jpg)

. January 25 2022 900 AM PST. Canadian interest rates are forecast to rise next year but the heavy lifting will be done. At 1100 ET Tiff Macklem Governor of the Bank of Canada will hold a press conference in the Bank of Canadas auditorium.

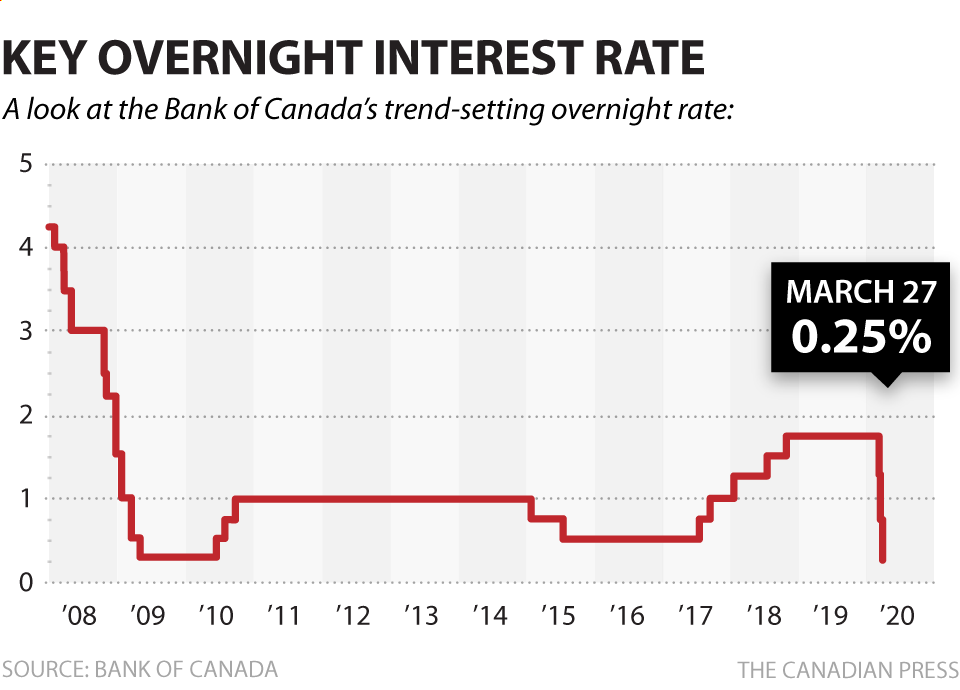

1000 ET On eight scheduled dates each year the Bank of Canada issues a press release announcing its decision for the overnight rate target together with a short explanation of the factors influencing the decision. Canadas March jobs report has cemented expectations for a 50bp interest rate hike at next weeks Bank of Canada policy meeting. When the pandemic started in 2020 the Bank Of Canada quickly slashed its interest rate 3 times from 175 to 025.

Morgan expect the Bank to. According to some forecasts the Bank of Canada BoC may heed that advice. Canadian Interest Rates To Top Out Fairly Fast.

All eyes will be on the Bank of Canadas rate decision on Wednesday which could see the largest rate hike in over 20 years. The rate has stayed there since. The rate announcement press release and the Monetary Policy Report will be available at 1000 ET on the Banks website.

Updated April 23rd 2021. No change is expected for the remainder of next year or the year after. The Bank of Canada is keeping its key interest rate target on hold at 025 per cent but warning it wont stay there for much longer.

Bank of Canada Interest Rate Forecast for the Next 5 Years. A majority of forecastsincluding from all of the Big Six banksexpect the BoC to increase interest rates another 50 basis points which would bring the target overnight to 320 increasing interest costs for variable-rate mortgage holders and. From 2023 onwards the outlook is less certain and highly dependent on global macroeconomic factors.

The Bank of Canada has raised its key interest rate for the first time since slashing the benchmark rate to near-zero at the start of the COVID-19 pandemic in a. Its the first time the bank has raised its rate since 2018. Investors expect the Bank of Canada will start an aggressive series of interest rate hikes this week as the central bank launches its campaign to wrestle inflation.

Gavin Graham chief strategy officer at SmartBe Investments joins BNN Bloomberg to discuss his outlook for Canadas central bank amid a rising interest rate environment. Federal Reserve according to. The Bank of Canada is expected to announce its first oversized interest-rate hike in more than two decades this week after hawkish comments from the.

The Bank of Canada kept its key interest rate on hold Wednesday but warned higher interest rates are coming to help it reel in inflation from its hottest pace in three decades. The Bank of Canada will soon starting hiking interest rates from record lows to combat inflation Governor Tiff Macklem announced on Wednesday saying the economy no longer needed help to deal. Employment rose 72500 versus the expected 79900 but this leaves total employment 442000 higher than the February 2020 pre-pandemic level.

To put that in terms of how most Canadians experience interest rates when the banks policy rate was last at 175 per cent the prime rate which commercial banks use to determine variable. Above we have predicted that the Bank of Canadas Target Overnight Rate will remain at 025 for 2021 and rise to 050 in 2022. Since a recession was setting in they cut the benchmark rate to help minimize it as a lower rate makes it easier for people to borrow money which helps stimulate the economy.

The BoC is forecast to hike 25 bps in Q2 2023 pushing the overnight rate to 175. Bank of Canadas Lowered Neutral Rate Means The. The opening statement will be available on the Banks website at 1100 ET.

He also speaks to why he believes there are tremendous investment opportunities in. The Bank of Canada will raise interest rates by 25 basis points on March 2 earlier than previously thought and ahead of the US. The Bank of Canada sign is seen in Ottawa on May 25 2020.

The Bank of Canada raised its benchmark interest rate to 05 per cent on Wednesday a move thats expected to be the first of a series of small rate hikes this year in an attempt to tame inflation. Before the pandemic the banks rate was 175 per cent before it. The Bank of Canada is gearing up to make its next move on interest rates this Wednesday with Bay Street forecasters expecting a 50 basis.

The Bank of Canada is widely expected to accelerate efforts to cool high inflation with a half-percentage-point increase in interest rates. The Bank of Canada raised its benchmark interest rate to 05 per cent on Wednesday a move thats expected to be the first of a series of small rate hikes this year in an attempt to tame inflation that has risen to its highest point in decades.

Bank Of Canada Raises Benchmark Interest Rate To 1 5 Noting Trade Tensions Cbc News

Interest Rates Are Going To Go Crazy Soon

Bank Of Canada Hikes Interest Rates Sets Stage For More Tightening Reuters

Bank Of Canada Slashes Key Interest Rate To 0 25 National Globalnews Ca

Kanada Zinssatz 1990 2022 Daten 2023 2024 Prognose

Bank Of Canada Signals Hikes Coming Soon Leaves Key Interest Rate Unchanged

Comments

Post a Comment